It’s no secret that Americans are anxious, divided and frustrated, but we still have many reasons to feel emboldened and hopeful. William Falk, Time magazine’s current editor-in-chief, wrote an end-of-year letter dated Dec. 31, 2021, summarizing the year. He ended with a reminder that the world also felt dark 80 years ago during World War II, at the end of 1941. However, that generation refused to surrender and eventually won the war.

A Look at History

In their book The Second Machine Age, Rick Brynjolfsson and Andrew McAfee analyzed the wages for full-time, full-year U.S. male workers between 1963 and 2008. They classified workers by educational attainment, from advanced degrees to high school dropouts. All the groups had increased prosperity 1963-1973; wages stagnated 1973-1982. In 1982, the information age began to reward education. Those rewards resulted in highly technical or specialized educations prospering, but not everyone received the same rewards.

To analyze the housing shortage, we can look at the Federal Housing Finance Agency Housing Price Index (1977-2020). By far, the worst drop during that period was a 12.1% drop during the Great Recession. However, home appreciation for 2020 was at 28.3%. (The previous highs were 20.1% around 1979, 18.3% around 1994, and 17.2% around 2006.)

The housing crisis is not the first time supply has outpaced demand, but shortages over the last decade have accumulated. Until 2017, there was a discrepancy between dwelling units and household formations. People formed more households than they built residences. Since then, Utah has been working to close the gap by building more residences. According to UtahRealEstate.com records from 2000 on, residential units had a median number of days on the market of 87 days in 2011. By the end of July 2021, the median was only 6 days.

The pandemic prompted the Great Resignation, especially among boomers. According to the Bureau of Labor Statistics, being close to retirement age and having the wealth to retire early has allowed boomers to retire earlier than expected.

“I-We-I” describes what has happened in the U.S. between 1880 and 2020. Author and political scientist Robert D. Putnam examined individualism and cooperation against four trends (economic, political, social and cultural). Individualism was prevalent at the beginning of that period, followed by increased cooperation until the Eisenhower presidency. After that, though, cooperation began dropping again. Although individualism benefits personal freedom and innovation, it can also cause inequities that increase social strife.

In 2020, the U.S. Census Bureau identified Utah’s 18.4% change, 2010-2020, as the fastest-growing increase of any state in the country. A third of that growth is in Utah County, followed by 15.9% in Salt Lake County. In the 2020-2021 period, Utah County’s population grew by 2.9%. Salt Lake City’s population grew by 0.8%. Numerically and politically, Utah’s power is shifting south.

In terms of job growth, the U.S. has had three recessions since January 2000 and October 2021: one in July 2001, the Great Recession and a pandemic recession in April 2020.

Business in Utah is very different from business elsewhere. Utah has outperformed the U.S. on employment even during severe downturns and snapped back fast. December 2019-December 2021, four states had positive job growth: Utah (3.7%), Idaho (2.3%), Texas (1.0%) and Arizona (0.7%). Overall, the U.S. had a 1.8% job decline during the same period.

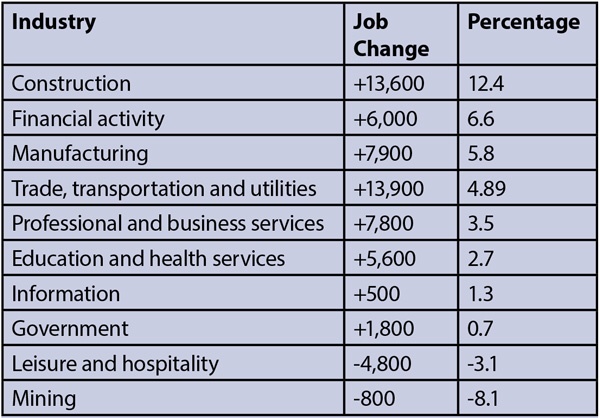

The following table from the Utah Department of Workforce Services shows that Utah’s job growth or losses were concentrated in 10 industries:

Among other factors, the white-hot construction market is caused by housing needs, and the manufacturing industry’s growth is caused by a desire to shorten supply chains.

Business Intelligence

Since business leaders face serious challenges from many different factors, it makes it easy to see which possible risks could derail the economy by putting these challenges into a risk matrix, where the x-axis measures the economic severity of a potential shock and the y-axis measures the likelihood of that shock.

One important risk has to do with U.S. global supply chain stress. Moody’s Analytics did a chart defining “pre-pandemic normal” as 2019 Q4 = 100. Then they looked at the years 2009 through part of 2021. During the first part of 2021, supply chain stress caused high inflation. Another chart, based on information from BLS and Moody’s Analytics, showed the pandemic recession in 2020 and inflation in 2021. The chart also shows the Federal Reserve forecast. The Federal Reserve appears confident that raising interest rates will reduce inflation within a year or slightly longer.

Federal fiscal support for those affected by the pandemic has been unprecedented. During 2020 and 2021, the federal fiscal response totaled 24.6% of the gross domestic product. Those numbers come from the Congressional Budget Office and the National Bureau of Economic Research.

Guidelines make important decisions easier. The following guiding principles might help leaders make the best possible decisions.

The first is practicing warm-heartedness. Arthur Brooks once asked the Dalai Lama what to do when he felt contempt, and that was the Dalai Lama’s answer.

The second recommendation is from Jon Meacham, author and historian, who said discernible reality does exist. Although there might be disagreement about causes and solutions, you can find common ground with facts, respect the facts and then rely on wisdom to move on.

The third recommendation, finding balance, was prompted by the current president of the University of Utah, Taylor Randall. During an earlier part of the pandemic, he commented that people who focus on one problem lose perspective.

Strategies to Succeed

Phil Dean, a senior research fellow at the Gardner Institute, suggested four strategies. The first is to prepare for economic re-sorting. The pandemic brought demographic changes; for example, we now have Zoom towns and employees who get their checks from out of state. The pandemic also accelerated other technological trends such as online school, telehealth and remote sales. Behavioral change has come from a new preference for working from home. Remote work is here to stay: Moody’s Analytics did a graphic of net out-migration from 10 major urban core locations, 2007-2021. It shows a sharp increase in out-migration, starting mid-2020.

Second, take care of yourself and others. Before the pandemic, the State of Utah Department of Human Services published a 2017 Prevention Needs Assessment Survey about Utah Youth that examined statistics from 2013, 2015 and 2017. The percentage of youth with problems increased for each of the years considered.

Third, take care of those who are left behind. We have good reasons for being worried about the pandemic causing students, Utah’s future workforce, to be left behind academically. The Utah State Board of Education and the National Center for Improvement of Education Assessment examined English language arts and math skills for grades 5-8. They found that learning disruptions had had a definite negative impact on these subjects.

Finally, it’s important to invest in institutions. People need society’s institutions to shape their social lives, connect with others and be replenished. But many people have lost trust, respect, faith and confidence in these institutions, and society has suffered as a direct consequence. We need to repair the damage.

Further insight from our conversation with Natalie Gochnour

Q: What are the economic effects on the economy as the boomer generation moves into retirement?

A: Utah differs from the rest of the country because the state has more millennials than boomers. However, the pandemic has accelerated the economic impact of boomer retirements. There will be a rippling effect as boomers move out of decision-making roles.

Q: Are there areas with housing surpluses instead of shortages?

A: Although some rural communities have housing surpluses, northern Utah, southwestern Utah and urban Utah all have housing shortages. Other states have some different housing dynamics. There are supply and labor constraints for housing, and the nation is still growing, which means the current housing market is an owner’s or seller’s market.

Q: What do you think about the inland port, the airport and the prison?

A: Everyone on Capitol Hill is very mindful of what they call generational investments. As a result, really solid things are happening financially in our state.

Current state investments include the Point of the Mountain, the prison, the inland port and the 2030 Olympic winter games. The Point of the Mountain is on its way. Our state doesn’t just want field housing. Our leaders have decided to develop the land for a public purpose. Point of the Mountain will be a job creation center with some housing and open space.

Our state has decided to push the Inland Port through and has set aside money for it. The Inland Port is a generational investment and will make Salt Lake City a place where we are tightly tied into the global supply chain.

Q: What are you keeping an eye on in terms of possible Federal Reserve missteps?

A: There is a lot of liquidity in this economy. The Federal Reserve brought the rates down and did what it needed to keep the United States of America performing as well as it could during the pandemic, but now they’ve got to get rates up. We have a fed that is very proactive. It won’t rest on the sidelines.

What am I watching? I’m watching labor force participation, consumer confidence, employment and job growth. I don’t want to be surprised, and I don’t think markets want to be surprised, either.

Q: How much will inflation slow down when rates rise, and how persistent will it be?

A: Anybody who studies economics is in the spotlight right now. Everyone is suddenly talking about inflation, which hasn’t happened for a long time. Channel 5 did a special about it. I want people to understand that economists and policymakers know what inflation is and how to work with it. To give you an example, they asked whether it is transitory or long-term. I answered that the fed can absolutely stop it; they just cause a recession when they do. Nobody wants that. Recessions are hard, and we just had one. The question is, what do you need to do to manage it in this environment? I’m going to be a little vulnerable here, but I think people are a little too skittish and afraid.

Let me give you an example. I think the inflation for the calendar year 2021 was 4.3%. People see bigger numbers, and it scares them, but they don’t realize that you are always dealing with starting dates and ending dates for that reference. They want to see December of last year and December of this year, and if it’s 5.6%, boom, they tear their hair out, but the average is 4.3%. I look at the state forecast about what’s going into the budget. In October 2021, their forecast was 3%; hence, the governor’s budget added a 3.5% cost of living increase. They looked at the 4.3% and the 3% and picked an average.

What’s the root cause of the inflation? We know supply chain problems are pushing costs up, so there’s a supply-side phenomenon. There’s also all this money out there. Too much money is chasing too few goods. We know they will figure out the supply chain. On the demand side, the demand is from excess savings, which gets spent; stimulus, which gets spent; and pent-up demand: things we couldn’t do, like travel. We couldn’t travel before, but we want to travel now. All of that will happen.

The amazing thing is that markets correct. For me, the question is, how well do we manage it moving forward? I have some optimism about inflation because of our leaders and the monetary policymakers. I don’t think we’ll be through with inflation, but I think we’ll be a lot better than we are now. Some of the causes are temporary, we have the tools to deal with inflation, and we are on a roll. Perhaps the worst is behind us.

Q: Unemployment is a natural part of the economy. But there has been a lot of discussion at every level about full employment fixing the economy. What is the rate of natural employment you are looking at to maintain a healthy economy?

A: As a rule of thumb, you want to have at least a 3.5% unemployment rate and a labor force participation of about 63%-64% nationally. That’s what we’re looking at. The other thing we’re looking at for full employment is rising wages. We expect wages to rise when there is full employment. We have both of those things challenging the Utah economy right now. Our unemployment sits at about 1.9%, which is incredibly low. I would make the case that we are at full employment in Utah, and the nation is getting close.

Q: What is the relative value of education going forward? How do we as a state make sure that those most vulnerable among us have educational opportunities?

A: I’ve worked with higher education. It has the most incredible mission to save people’s lives and give them the skills to be successful and prosperous, and I think we absolutely have a world that rewards education, but education has to change with the world. What can we do to help the people among us who are socially and economically disadvantaged? Give them the skills to succeed.

I think an earned income credit on Capitol Hill will pass this year. [It did.] It’s a tax credit that rewards people who work on the lower end of the pay scale. It’s proven to increase neighborhood participation rates and targets the exact people you want to help. We would join other states that do this, and there’s also a federal EITC. It’s one of those areas that both liberals and conservatives agree on. We’re getting a big income tax cut that benefits the rich, and the earned income tax credit benefits low income. They’re also going to change Social Security income. [They did.] That way, there will be a fair spread of our tax cuts.

Natalie Gochnour is the director of the Kem C. Gardner Policy Institute at the University of Utah, the associate dean in the David Eccles School of Business, and the chief economist for the Salt Lake Chamber, which represents 7,700 business members. She received a bachelor’s and master’s degree in economics from the University of Utah and has specialized in teaching public finance. Her public service includes working as an associate administrator at the Environmental Protection Agency and as a counselor to the secretary of Health and Human Services during the presidency of George W. Bush. Later, Natalie advised Gov. Norm Bangerter, Gov. Mike Leavitt and Gov. Olene Walker. The Salt Lake Chamber recently honored her with the 2021 ATHENA leadership award.

Natalie often speaks about what she sees in Utah’s economic future. Her recent forecast, “A Warm Winter Stew,” was used to write the above article, but her presentation and the Q&A session at the end are not transcribed exactly and have been edited for length.